Powerful Tools for Smart Investors

Custom Stock Alerts provides a comprehensive suite of tools to help investors of all types stay on top of the market. From real-time alerts to advanced analysis tools, everything you need is at your fingertips.

More tools are always being designed and suggestions are always welcome.

Real-Time Alerts

Get instant notifications via Email or SMS when your alerts trigger. Never miss an opportunity.

Mobile Friendly

Fully responsive design works perfectly on any device. Manage your alerts on the go.

Easy to Use

Intuitive interface with powerful capabilities. Set up alerts in seconds, not minutes.

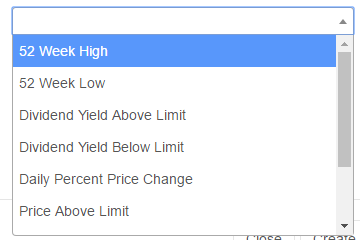

Stock Alert Types & Monitoring Options

- Price Above/Below X

- 52 Week High/Low

- Dividend Yield Above/Below X

- PE Ratio Above/Below X

- Daily Price Percent Change (Premium)

- Price Above/Below 50/200 Day Moving Average (Premium)

- Golden Cross / Death Cross (Premium)

- MACD Cross Above/Below Signal (Premium)

- RSI Above/Below Threshold (Premium)

Our Investment Tools & Stock Analysis Features

Stock Alerts

Create custom alerts based on price, dividend yield, PE ratio, and more. Get notified instantly when conditions are met.

Ex-Dividend Alerts

Never miss a dividend payment. Get alerted before ex-dividend dates and when companies increase their dividends.

Stock Screener

Find investment opportunities with our powerful screener. Filter by market cap, dividend yield, PE ratio, and more.

Stock Return Calculator

Compare investment performance across multiple stocks. Includes DRIP calculations and handles stock splits automatically.

Dividend Calendar

View all upcoming dividend payments in one place. Track dividend growth streaks and identify opportunities.

API Access

Integrate Custom Stock Alerts into your own applications. Full API access available for premium subscribers.

Stock Alerts

Create custom stock alerts in just a few simple steps. Get notified instantly when your conditions are met.

Use Cases for Stock Alerts

- Price Entry Points - Set alerts for when stocks drop to your target buy price. Perfect for value investors looking for entry opportunities.

- Exit Strategy - Get notified when stocks reach your profit targets or stop-loss levels. Essential for managing risk and locking in gains.

- 52-Week High/Low Tracking - Monitor when stocks hit new highs or lows to identify momentum shifts or oversold conditions. Get clear, descriptive messages like "AAPL has hit a new 52-week high of $200.00" or "MSFT is 5% off its 52-week low of $350.00".

- Valuation Alerts - Track PE ratios to find undervalued stocks or identify when valuations become stretched.

- Dividend Yield Monitoring - Set alerts for dividend yield thresholds to build or maintain income-focused portfolios. Messages include current yield values (e.g., "DIVO's dividend yield of 4.63% is above your target of 4.00%").

- Moving Average Crossovers - Premium feature alerts when stocks cross key moving averages (50/200-day), helping identify trend changes. Messages include both current price and moving average values for complete context.

- Golden Cross & Death Cross - Get alerted when the 50-day MA crosses above (Golden Cross) or below (Death Cross) the 200-day MA.

- MACD Crossovers - Alerts when the MACD line crosses above or below its signal line for momentum signals.

- RSI Thresholds - Set alerts for when RSI (14) goes above or below your chosen level (e.g. overbought above 70, oversold below 30).

Smart Alert Delivery

- Email Digests: Receive beautifully formatted HTML emails with all your alerts in one organized table, including direct links to view quotes and manage alerts.

- SMS Digests: Multiple alerts are grouped together in a single message. For longer digests, messages are intelligently split with pagination (e.g., "1/2", "2/2") so you never miss important information.

- Smart Formatting: All alerts include complete context - current values, target values, and clear descriptions of what triggered.

How It Works

Pick your ticker symbol

Pick your alert type

Enter your target value

Click Create - That's it!

Technical Indicator Alerts Premium

Get notified when stocks hit key technical signals—Golden Cross, Death Cross, MACD crossovers, and RSI levels—so you can act on momentum and trend changes without watching charts all day.

What Are Technical Indicator Alerts?

These alerts use classic chart indicators that many traders and long-term investors follow. We calculate 50-day and 200-day moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) from our price data and alert you the moment a condition is met.

Golden Cross & Death Cross

When the 50-day moving average crosses above the 200-day, it's called a Golden Cross—often seen as a bullish trend signal. When it crosses below, it's a Death Cross—often seen as bearish. Get one alert type for each so you can follow trend changes on your watchlist.

MACD Cross Above / Below Signal

MACD compares short- and long-term momentum. When the MACD line crosses above its signal line, it can signal building bullish momentum; when it crosses below, it can signal weakening momentum. We alert you on the day of the crossover.

RSI Above or Below Your Level

RSI (14) ranges from 0 to 100. Values above 70 are often considered overbought; below 30, oversold. You choose the threshold (e.g. 70 or 30), and we alert you when the stock's RSI crosses that level—great for mean reversion or confirmation.

Ex-Dividend Alerts

Never miss a dividend payment. The ex-dividend alert tool notifies you prior to a stock or ETF paying out its next dividend. Use this information to start or add to a position before the ex-dividend date.

Use Cases for Ex-Dividend Alerts

- Opportunistic Buying - Get alerted before ex-dividend dates to capture dividend payments. Perfect for timing entry points to maximize dividend income.

- Income Tracking - Monitor upcoming dividend payments across your portfolio. Essential for dividend investors managing cash flow and income planning.

- Dividend Growth Monitoring - Receive alerts when companies increase their dividends, helping you identify dividend growth stocks and track income growth over time.

- Portfolio Rebalancing - Use ex-dividend dates as natural rebalancing opportunities, especially when combined with our return calculator for strategic planning.

Key Features

- Alerts sent via your preferred notification method (Email or SMS)

- Includes percentage change information when dividends are increased

- Highly responsive table with fast loading times

- Sort by any field or filter with the search box

- Premium Feature: Automatically import dividend-paying companies from your stock alert list

Live Demo

Stock Screener

Find investment opportunities with our powerful stock screener. Use flexible double-handled sliders to fine-tune parameter ranges and discover stocks that match your criteria.

Stock Screener Filters & Search Options

- Market Cap - Filter by company size

- Dividend Yield - Find dividend-paying stocks

- PE Ratio - Screen by valuation metrics

- 52 Week Range - Identify stocks near highs or lows

- Equity Types

- Stocks

- ETFs

- Preferred Shares Coming Soon

- More filters in the pipeline

Stock Screener Features & Export Options

- Highly responsive table with fast loading times

- Sort by any field or manually filter with the search box

- Hide or reset filters with one click

- Export your results:

- Excel format

- CSV format

- PDF format

Live Demo

Stock Return Calculator

Compare investment performance across multiple stocks with our comprehensive return calculator. Calculate returns with periodic investments, dividend reinvestment (DRIP), and automatic stock split adjustments. Includes advanced risk analysis and interactive visualizations.

Use Cases for Stock Return Calculator

- Deep Investment Analysis - Perform comprehensive analysis on different investment options to meet and maximize your investment results. Compare up to 10 stocks side-by-side with advanced risk metrics.

- Portfolio Strategy Comparison - Evaluate different investment strategies using preset ticker groups. Compare dividend growth ETFs, index funds, or sector-specific investments.

- Risk-Adjusted Performance - Analyze volatility, Sharpe ratio, and maximum drawdown to understand risk-adjusted returns, not just raw performance numbers.

- DRIP vs Cash Analysis - Compare scenarios with and without dividend reinvestment to see the power of compounding and make informed decisions about dividend strategies.

- Dollar-Cost Averaging Planning - Model regular investment contributions (monthly, quarterly, annually) to see how periodic investments affect long-term returns.

- Investment Decision Support - Use comprehensive return breakdowns, risk analysis, and interactive charts to make data-driven investment decisions.

Key Features

- Compare up to 10 tickers side-by-side

- Analyze up to 20 years of historical data

- Works with over 8,000 ticker symbols (stocks, ETFs, and more)

- Periodic Investment Calculator - Simulate regular contributions (monthly, quarterly, semi-annually, or annually)

- Dividend Reinvestment (DRIP) - Automatically reinvest dividends to see compound returns

- Handles stock splits automatically

- Normalized date ranges for fair comparisons

- Interactive Charts - Line and area charts with multiple export options

- Risk Analysis - Volatility, Sharpe ratio, Sortino ratio, Calmar ratio, and maximum drawdown

- Risk vs Return Scatter Plot - Visualize risk-adjusted performance

- Drawdown Analysis - See peak-to-trough declines over time

- Return Breakdown - Price appreciation vs dividend income analysis

- Quick Preset Strategies - Pre-configured ticker groups for popular investment strategies

- Export results (Excel, CSV, PDF, PNG)

Advanced Investment Analysis Capabilities

- Dollar-Cost Averaging - Model regular investment contributions over time

- Compare Scenarios - See results with and without dividend reinvestment side-by-side

- Risk Metrics Comparison - Compare volatility, Sharpe ratio, and other risk metrics across all investments

- Best/Worst Value Highlighting - Automatically highlights top and bottom performers in key metrics

- Index Comparison - Compare against market indices using their corresponding ETFs (SPY for S&P 500, QQQ for NASDAQ, etc.)

How to Use the Stock Return Calculator

- Select Stocks - Search and select up to 10 ticker symbols using our stock screener, or use quick preset investment strategy groups

- Set Investment Parameters - Enter initial investment amount and optionally enable periodic investments

- Choose Date Range - Select dates or use quick buttons (MTD, QTD, YTD, 1Y, 3Y, 5Y, 10Y, Max)

- Configure Dividend Options - Choose DRIP, cash collection, or calculate both scenarios

- Analyze Results - View detailed comparison table, interactive charts, risk analysis, and return breakdowns

Ready to Get Started?

Join nearly 5,000 investors using our tools today. Nearly 10,000 alerts are actively set up across the platform. Free accounts available with premium features for power users.

Sign Up Free View Pricing